Our comprehensive Financial Wellness Planning model builds an orderly and long-term financial plan that is unique to each family’s needs at every stage of life to ensure happy moments and peace of mind throughout the life. A continued evaluation of the plan forms the backbone of the Financial Wellness Planning model.

A complete understanding of the personal resources

Are you parenting a special needs child? Then you may ultimately agree that “The most difficult thing is the decision to act.”

Act early. Act in the right direction.

It is crucial to start as early as possible since special needs financial planning requires planning for two generations. A clear road map of future financial strategies is critical for long-term success. The myriad of challenges and day-to-day support for a child with special needs requires the exponential expenditure of funds. Comprehensive special needs planning helps to mitigate some of these challenges. Unique goals, unique priorities, unique requirements for a special needs family calls for a personalized financial plan that is kept up to date.

We at IRIS work on the philosophy of transparency, robustness, and flexibility. We assess your current situation and devise individualized financial future strategies for every family member. Our continual monitoring process and ongoing guidance maintain and protect the standard of living of your family.

We will always be there for you to celebrate your successes and share your challenges at different milestones of your life’s journey.

Special needs financial planning is about carving a path for you and your family by continually assessing your requirements and the expenses incurred for the all-round health of your child. Your proactive approach towards future financial planning ensures the physical, emotional and financial well-being of your child. To see your initial small investments gradually rise is always motivating and inspiring.

We consider earnings, assets, retirement accounts, taxes, social security, housing, and other needs to calculate the annual spending budget that preserves your living standard. It is a plan that provides the following:

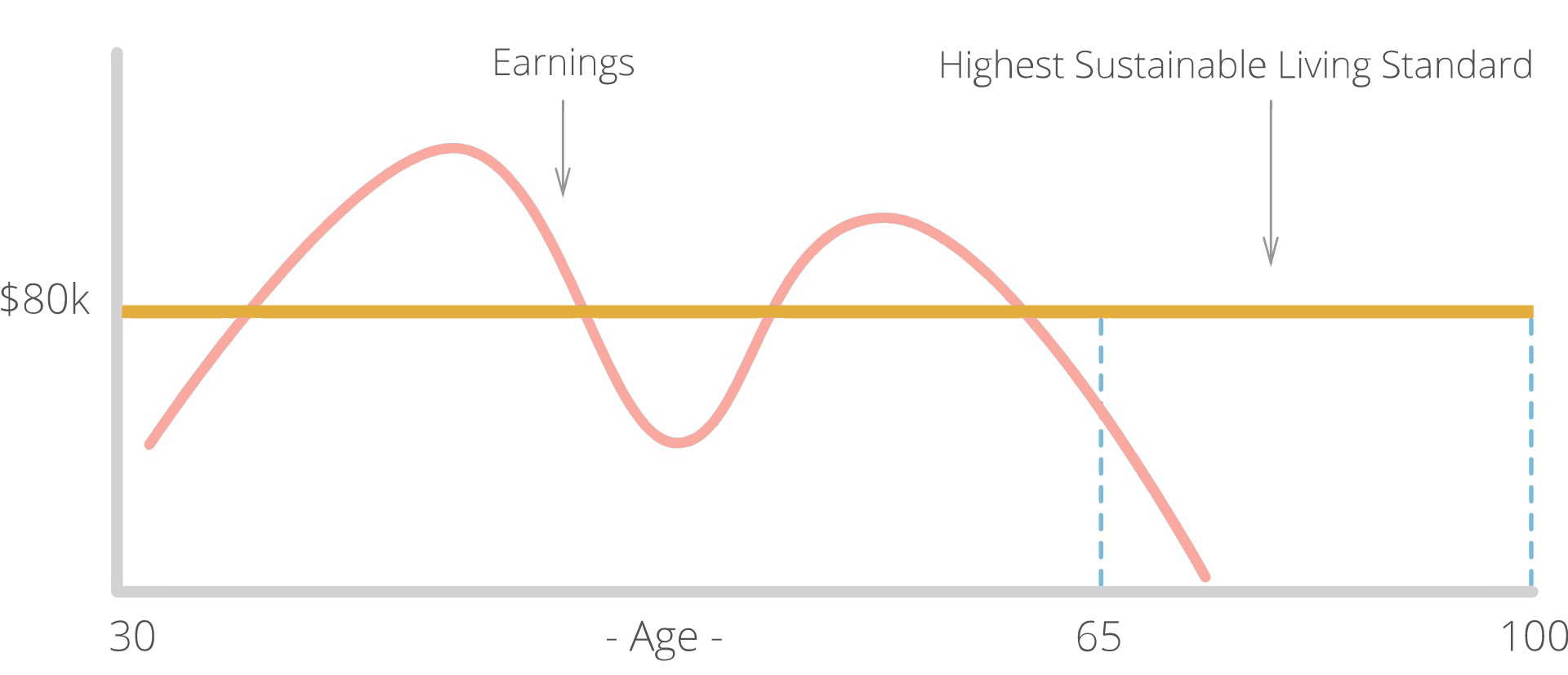

We follow the Consumption Smoothing approach to create a plan where the spending and expenditure remains the same throughout the life’s journey. This approach is based on the groundbreaking theory called the Life-Cycle Hypothesis of saving and consumption that finds the highest spending levels that sustains for life.

From a current situation, we optimize your financial plan by running thousands of scenarios to find safe ways to improve your standard of living. Some of these strategies include

We provide guidance that takes the guesswork out of financial decisions at every stage of life; we can give unlimited what-if scenarios to see how different choices impact the overall financial plan and standard of living. Whether it is buying a new car, downsizing, or changing savings contributions, we can help analyze the impact of these decisions so that you can make an informed decision.

Our progress tracker keeps track of how your financial plan evolves and updates to guide you and help you stay on track with income, spending, and saving targets. It is also motivating to see your assets grow over the period of time.

The risk and reward analysis helps to decide the next step of a financial plan. Our Monte Carlo simulations let you compare living standard risk and reward from different investment strategies and spending behavior.

We employ The Monte Carlo method to help you manage your living standard risk with confidence. We evaluate your different annual spending trajectories based on the investment returns you earn over time so you can adjust your future spending in light of your past returns.

We use methods such as Upside Investing and Full Risk Investing. By analyzing different investing strategies and spending behaviors you can quickly assess their risk and choose the combination that provides the right balance of living standard risk and reward.

Your decisions will help us churn out your best financial plan. We work together with you and your family to roll out a unique plan for you and your loved ones.

Together we can lay a firm foundation for your financial goals.

Let us make your initial steps simpler

We would love to talk to you to learn and understand everything about you.

Let us together begin to shape your goals and expectations.

We would love to know your current and future financial picture based on what you're doing today.

With your help, we will analyze your current status and adjust your financial plan.

We will work with you and your family to mobilize a financial plan per your goals.

We will monitor your financial plan to celebrate your successes and prepare you for unexpected changes.

Fill up the form

Special Needs financial planning is entirely different from traditional financial planning as it requires planning for two generations. You plan for your retirement and the retirement of your loved ones. The increased financial responsibilities require focus on a few additional areas. A well-guided approach to financial planning is very crucial.

Traditional Plan Elements

Wealth Transfer / Estate Planning / Charitable Giving / Retirement Distribution Planning

Special Needs Plan Elements

Team To Carry On / Special Needs Trust Funding And Management / Asset Ownership / Beneficiary Designations / Gifts And Inheritances / Multi- Generational Planning

Traditional Plan Elements

Retirement Planning / College Planning / Investment Planning

Special Needs Plan Elements

Planning For Two Retirements / Lifetime Support Needs / Transitional and Vocational Planning / Housing Options And Funding Strategies / ABLE Account

Traditional Plan Elements

Cash Flow Management / Emergency Savings / Home Purchase

Special Needs Plan Elements

Supplemental Expenses For Child With Special Needs / Identifying And Protecting All Government Benefits

Traditional Plan Elements

Medical, Home, Auto, and Life Insurance / Protection For Loss Of Income Due To Death or Long-Term Disability / Long- Term Care/ Living standard risk management

Special Needs Plan Elements

Government-Supported Supplemental Health Care / Comprehensive Life Insurance Planning

Traditional Plan Elements

Wills / Trusts / Health Care Proxies / Power Of Attorney

Special Needs Plan Elements

Special Needs Trusts / Trustees & Successors / Guardianship / Letter Of Intent / Advocacy

Traditional Plan Elements

Federal & State income taxes / Itemization decision / Capital gains and dividends / Social Security benefit taxation / Capital gains on home sales / Self-employment tax

Traditional Plan Elements

Federal & State income taxes / Itemization decision / Capital gains and dividends / Social Security benefit taxation / Capital gains on home sales / Self-employment tax

We are an independent, fee-only, fiduciary financial planning practice. We offer flat fee structure that is based on complexity and the amount of time that we dedicate together for your goals.

One-time financial planning (~ $2000 - $5000 depending on complexity)

Ongoing Financial guidance (~$1500 initial plan, $200-$400 per month)

Project based work (~$300 per hour)

Traditional Plan Elements

Retirement benefits / Spousal and divorced spousal benefits / Widow(er) and divorced widow(er) benefits

Special Needs Plan Elements

Child-in-care spousal benefits / SSI & SSDI benefits / Child survivor benefits